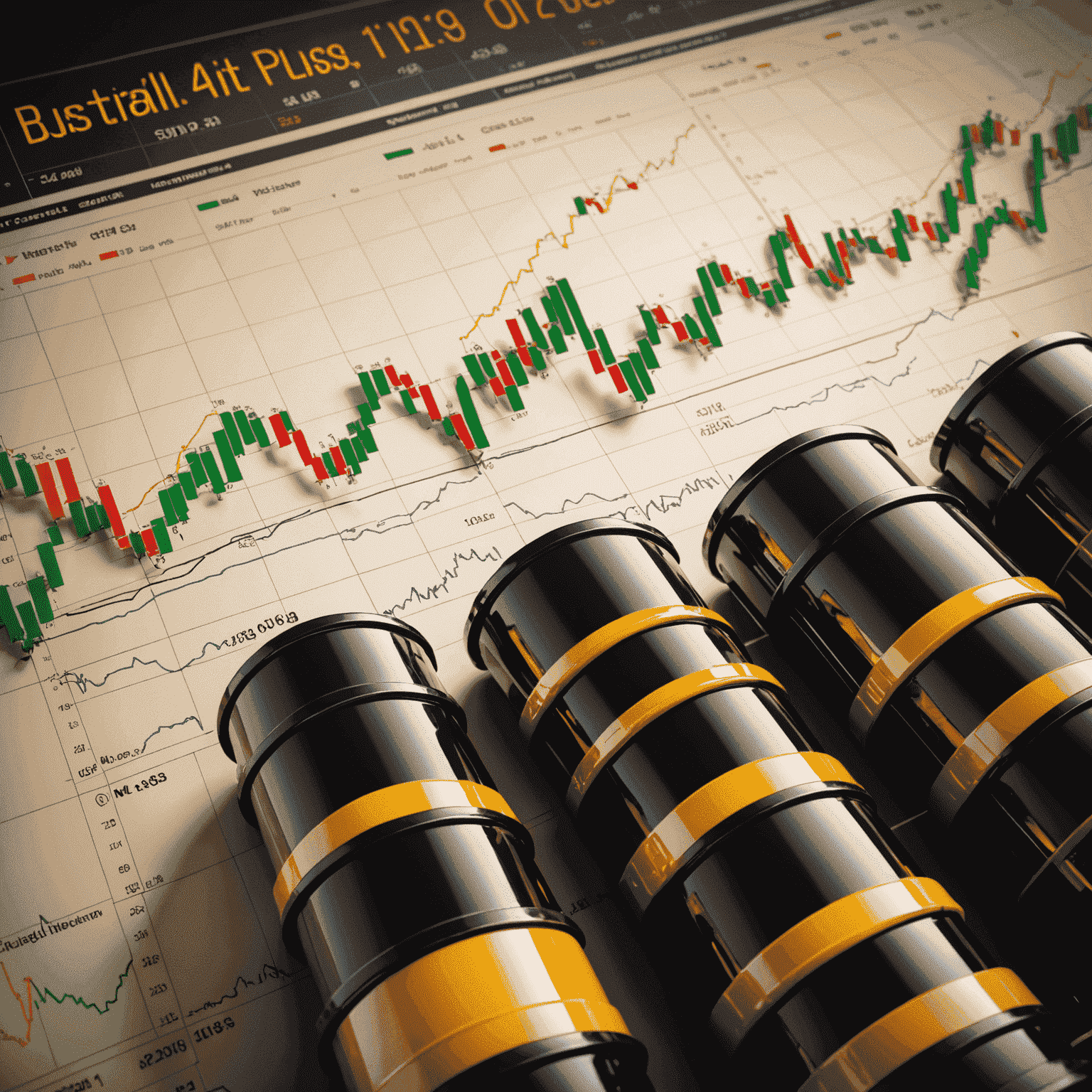

Oil Trading Strategies for Beginners

Entering the world of oil trading can be both exciting and daunting for beginners. This guide will walk you through essential strategies and techniques to help you start trading oil successfully and potentially create a steady stream of passive income.

1. Understand the Oil Market

Before diving into trading, it's crucial to grasp the basics of the oil market. Familiarize yourself with key terms, major players, and factors that influence oil prices such as geopolitical events, supply and demand, and economic indicators.

2. Start with Paper Trading

Practice your strategies without risking real money by using paper trading platforms. This allows you to test your ideas and gain confidence before entering the live market.

3. Choose the Right Trading Instrument

As a beginner, consider starting with oil ETFs or futures contracts. These instruments offer exposure to oil prices without the complexities of direct commodity trading.

4. Implement Risk Management

Always use stop-loss orders to limit potential losses. A good rule of thumb is to risk no more than 1-2% of your trading capital on a single trade.

5. Follow Technical Analysis

Learn to read charts and use technical indicators such as moving averages, RSI, and MACD to identify potential entry and exit points for your trades.

6. Stay Informed on Fundamental Factors

Keep track of OPEC announcements, weekly inventory reports, and global economic news that can impact oil prices.

7. Develop a Trading Plan

Create a structured approach to your trading, including entry and exit strategies, risk management rules, and profit targets. Stick to your plan to avoid emotional decision-making.

8. Start Small and Scale Gradually

Begin with smaller position sizes as you gain experience. As your skills improve and you consistently see profits, you can gradually increase your trading volume.

9. Learn from Your Trades

Keep a trading journal to record your decisions, outcomes, and lessons learned. Regularly review and analyze your trades to improve your strategy over time.

10. Stay Patient and Disciplined

Oil trading can be volatile. Maintain a long-term perspective and avoid the temptation to overtrade or chase losses. Consistency and discipline are key to success in oil trading.

By following these strategies and continuously educating yourself about the oil market, you'll be well on your way to building a solid foundation for oil trading. Remember, success in trading often comes from consistent application of sound principles rather than seeking quick profits. With patience and dedication, oil trading can indeed become your path to a steady stream of passive income.