Understanding Oil Markets

The global oil market is a complex and ever-changing landscape that plays a crucial role in the world economy. For those looking to venture into oil trading as a path to passive income, understanding the key players and factors that influence oil prices is essential.

Key Players in the Oil Market

- OPEC (Organization of the Petroleum Exporting Countries): A group of major oil-producing nations that significantly influence global oil supply and prices.

- Non-OPEC Producers: Countries like the United States, Russia, and Canada that are not part of OPEC but still play important roles in oil production.

- Major Oil Companies: International corporations involved in exploration, production, refining, and distribution of oil.

- Traders and Investors: Individuals and institutions that buy and sell oil futures and derivatives, affecting market dynamics.

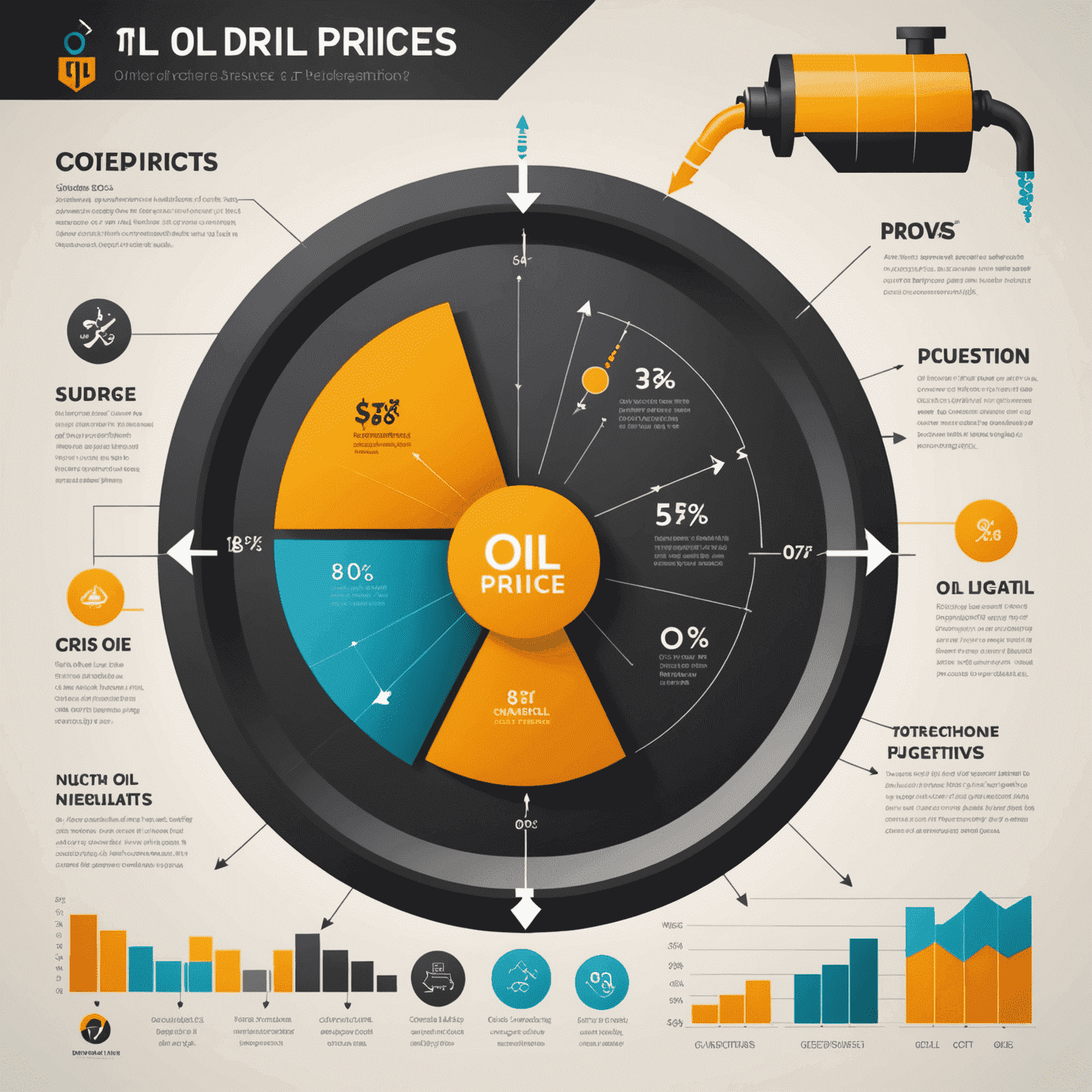

Factors Influencing Oil Prices

Supply-Side Factors

- OPEC production decisions

- Geopolitical events and conflicts

- Natural disasters affecting production

- Technological advancements in extraction

Demand-Side Factors

- Global economic growth

- Seasonal demand fluctuations

- Alternative energy adoption

- Government policies and regulations

Types of Oil Traded

Understanding the different types of oil traded is crucial for any aspiring oil trader. The two main benchmark crude oils are:

Brent Crude

Sourced from the North Sea, Brent Crude is the global benchmark for European, African, and Middle Eastern oil.

West Texas Intermediate (WTI)

The benchmark for North American oil, WTI is lighter and sweeter than Brent Crude.

The Role of Technology in Oil Trading

Modern oil trading has been revolutionized by technology. Traders now use sophisticated software for:

- Real-time market data analysis

- Algorithmic trading strategies

- Risk management and portfolio optimization

- Predictive analytics using AI and machine learning

Getting Started in Oil Trading

For those looking to enter the world of oil trading as a path to passive income, consider these steps:

- Educate yourself thoroughly on oil markets and trading strategies

- Start with paper trading to practice without financial risk

- Choose a reputable trading platform that offers oil futures or ETFs

- Develop a solid risk management strategy

- Stay informed about global events that can impact oil prices

- Consider seeking mentorship from experienced oil traders

Remember, while oil trading can be a lucrative path to passive income, it also carries significant risks. Always trade responsibly and within your means.